Learn how Coira's proprietary STRICT scoring system evaluates cryptocurrencies based on fundamental metrics, not hype.

Aria Chen

Lead Quantitative Analyst

At Coira, we believe in transparent, data-driven analysis. Our STRICT Score is a comprehensive metric that evaluates cryptocurrencies based on fundamental factors, not social media hype or price momentum.

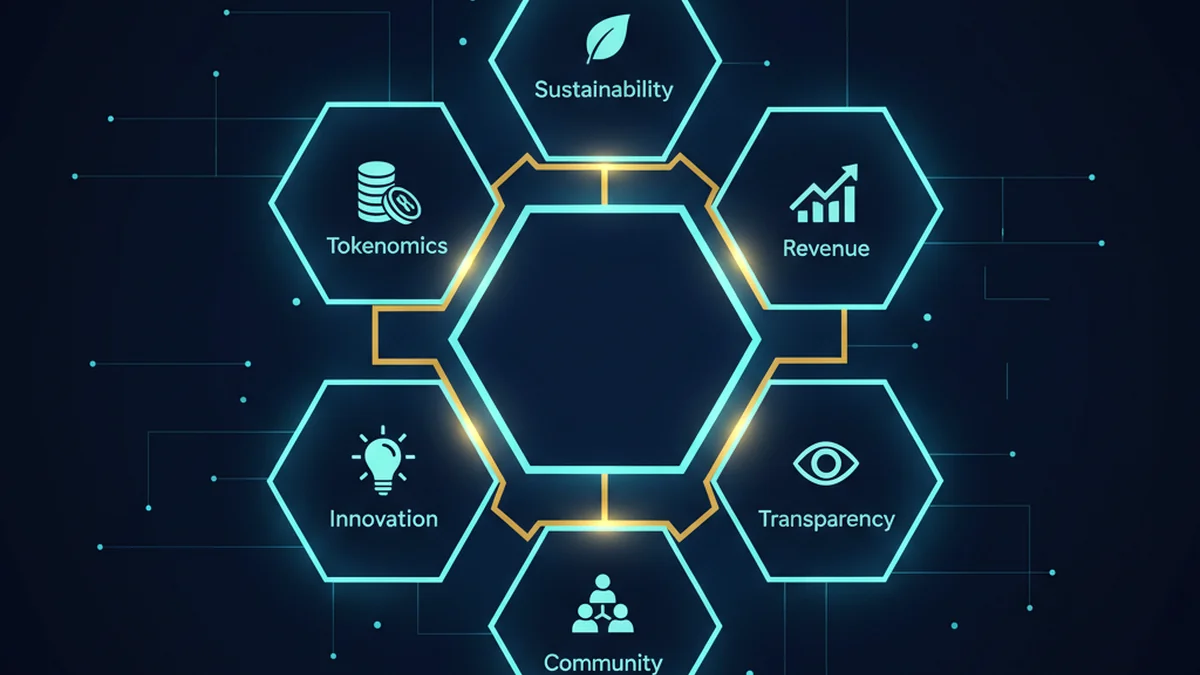

STRICT is an acronym representing six fundamental dimensions we evaluate for every cryptocurrency:

Long-term viability of the project, including treasury runway, revenue model, and partnerships

Team credibility, governance quality, audits, and communication standards

Actual protocol revenue, fees, and sustainable income (null for store-of-value assets)

Technical advancement, development activity, and competitive moat

Developer activity, user adoption, DAU metrics, and ecosystem growth

Token distribution, supply mechanics, inflation schedule, and utility

Each component is scored independently on a scale of 0-100:

| Component | Scale | What We Measure |

|---|---|---|

| Sustainability | 0-100 | Treasury health, runway, battle-tested code |

| Transparency | 0-100 | Team visibility, governance, communication |

| Revenue | 0-100 | Protocol fees, business model viability |

| Innovation | 0-100 | Technology uniqueness, dev activity |

| Community | 0-100 | DAU, ecosystem growth, adoption |

| Tokenomics | 0-100 | Supply mechanics, utility, distribution |

The overall STRICT score is a weighted average of these components, reflecting our assessment of long-term project health.

Revenue can be null for store-of-value assets like Bitcoin, as they are not designed to generate protocol revenue. In these cases, other factors carry more weight in the overall assessment.

Here's how a top-rated project like Aave might score:

"In the short run, the market is a voting machine. In the long run, it's a weighing machine." - Benjamin Graham

Price can be manipulated short-term, but fundamentals determine long-term value. Projects with real revenue, active development, and sustainable tokenomics tend to outperform over time.

Proven revenue models, active teams, strong governance, multiple income streams, battle-tested code

No revenue, anonymous teams, centralized control, unlimited inflation, unaudited contracts

Explore our rankings to see how your favorite cryptocurrencies score. Make informed decisions based on data, not hype.

Market analysis and actionable insights. No spam, ever.