The Dencun upgrade's blob transactions have dramatically reduced Layer 2 costs, driving unprecedented activity on rollup networks like Arbitrum, Optimism, and Base.

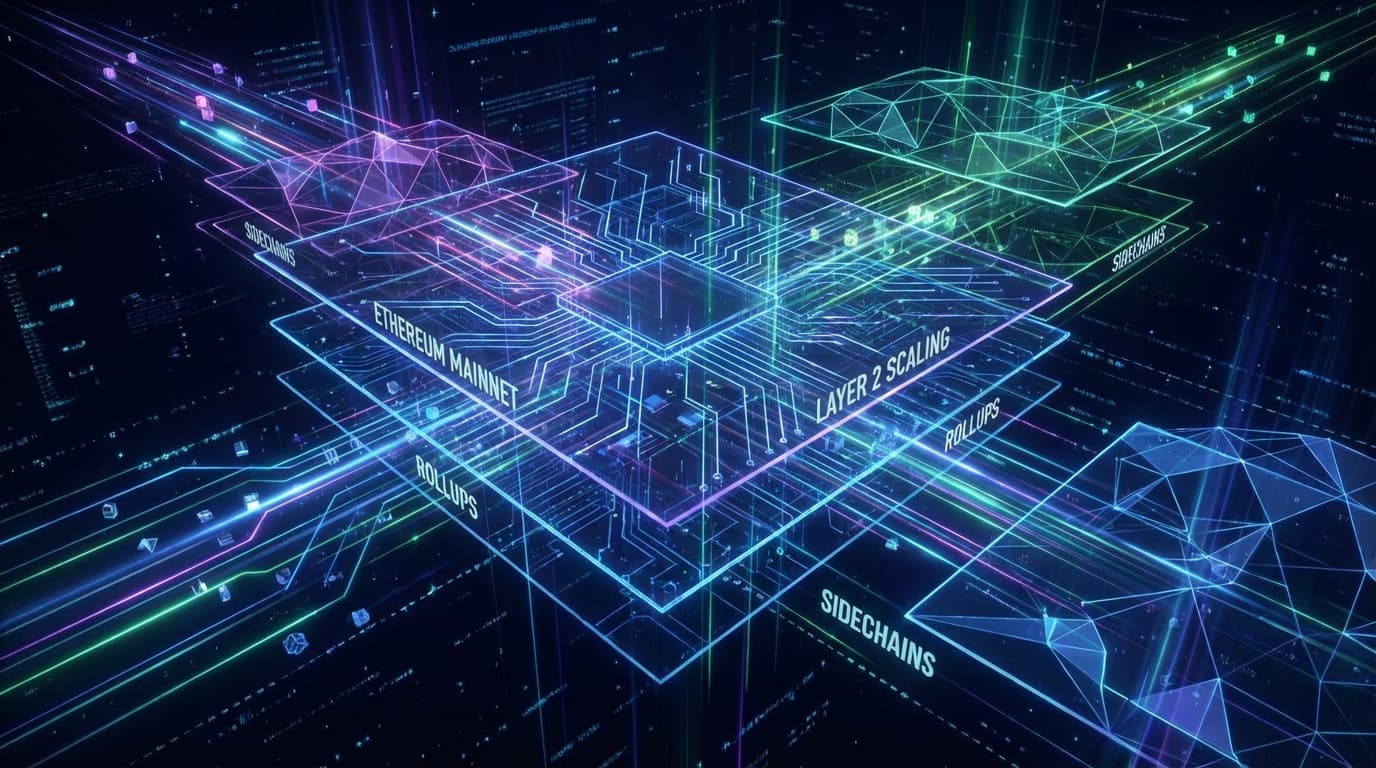

Ethereum's Layer 2 ecosystem has experienced explosive growth following the Dencun upgrade, with total value locked across major rollups reaching new all-time highs as transaction costs plummet.

The introduction of proto-danksharding through EIP-4844 has reduced Layer 2 transaction costs by up to 90% in some cases. Average transaction fees on Arbitrum and Optimism have dropped to under $0.01, making blockchain transactions economically viable for a much broader range of applications.

Base, Coinbase's Layer 2 network, has seen particularly strong adoption, with daily active addresses exceeding those on the Ethereum mainnet itself.

The cost reductions have sparked a renaissance in DeFi activity on Layer 2s. Decentralized exchanges on Arbitrum are now processing more trading volume than many centralized exchanges, while lending protocols on Optimism have seen deposits surge by over 200%.

This shift represents a fundamental change in how users interact with Ethereum, from occasional high-value transactions on mainnet to frequent, low-cost interactions on rollups.

The success of Layer 2 scaling validates Ethereum's rollup-centric roadmap. Rather than competing chains fragmenting liquidity, value is increasingly concentrated in the Ethereum ecosystem through its Layer 2 networks.

ETH has benefited from this activity, as all Layer 2s still pay fees to Ethereum mainnet for data availability and security, creating sustained demand for the native asset.

The Dencun upgrade marks a pivotal moment for Ethereum scaling, demonstrating that the network can achieve both decentralization and scalability. As Layer 2 activity continues to grow, Ethereum's position as the dominant smart contract platform appears increasingly secure.

The largest US bank is assessing spot and derivatives trading services as regulatory clarity enables traditional finance to deepen crypto involvement.

Investment firm Trend Research purchased 46,379 ETH on Wednesday, bringing total holdings to 580,000 ETH worth $1.72 billion with plans to buy $1 billion more.

Senator Boozman postpones Digital Asset Market Clarity Act from January 15 to final week of January to secure bipartisan support.

Disclaimer: News content is for informational purposes only and should not be considered financial advice. Market conditions can change rapidly. Always conduct your own research.