Wall Street firm forecasts stablecoins hitting $420B and tokenized assets doubling as three-sector growth accelerates.

Bernstein sees 2026 as the start of a tokenization supercycle, with stablecoins, real-world assets, and prediction markets set to drive crypto's next major rally.

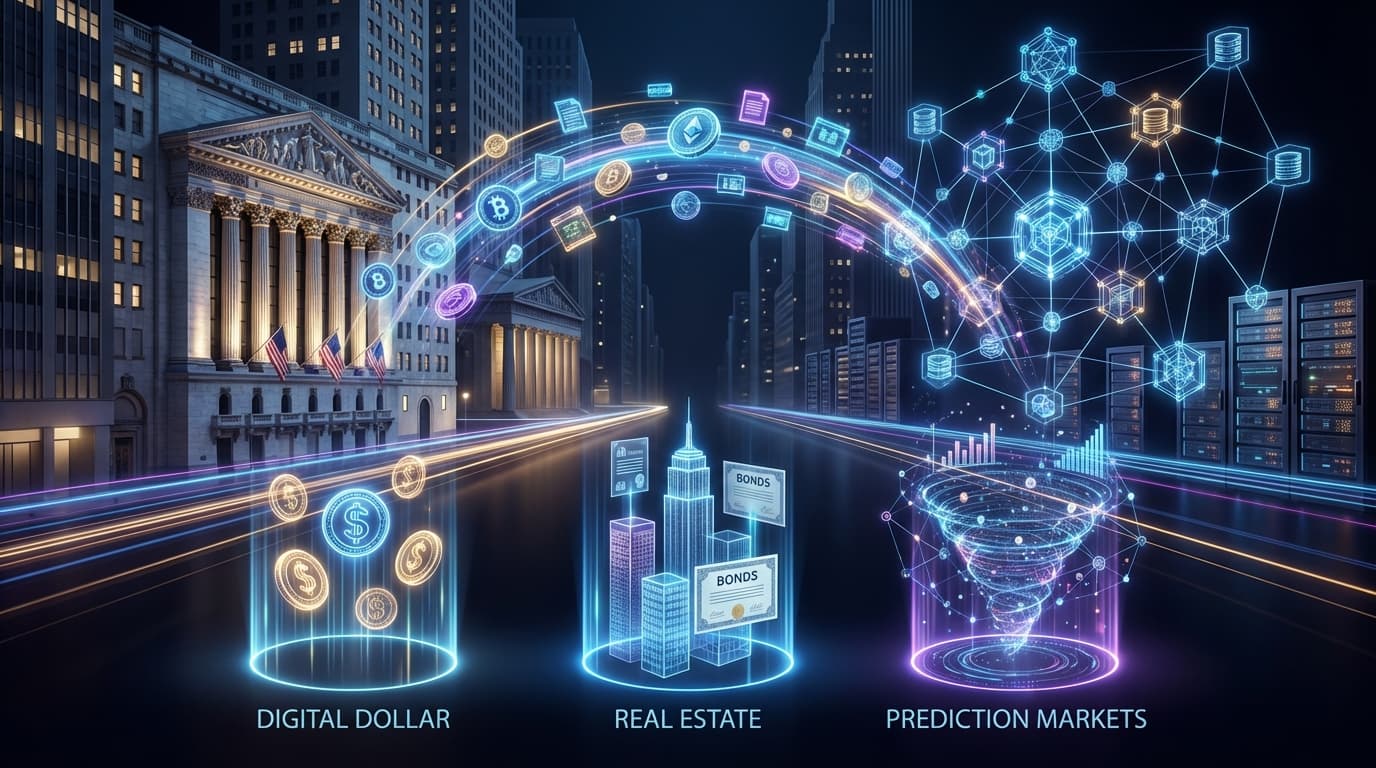

Wall Street research firm Bernstein released a comprehensive 2026 outlook report on January 7, declaring the year will mark the beginning of a "tokenization supercycle." The report identifies three growth sectors: stablecoins reaching approximately $420 billion in supply (56% year-over-year growth), tokenized real-world assets more than doubling from $37 billion to $80 billion, and prediction market volumes expanding 100% to $70 billion.

Bernstein maintained its $150,000 Bitcoin price target for 2026 and $200,000 peak cycle target for 2027. The firm noted that despite Bitcoin ending 2025 down roughly 6%, the underlying fundamentals for tokenization remain intact.

The tokenization thesis extends beyond crypto-native assets into traditional finance. Stablecoin growth is being driven by cross-border payments and neobank adoption, while tokenized RWAs include Treasury bonds, real estate, and private credit. Prediction markets, boosted by Polymarket's mainstream breakthrough during the 2024 election cycle, represent a new revenue stream generating an estimated $1.4 billion annually.

Bernstein highlighted Robinhood, Coinbase, Figure, and Circle as the best "tokenization proxies" for equity investors. However, the firm trimmed price targets on Coinbase to $440 from $510 and Circle to $190 from $230, citing near-term headwinds.

The tokenization narrative depends heavily on regulatory clarity. The GENIUS Act, signed in July 2025, established the first federal framework for stablecoins. The CLARITY Act markup scheduled for January 15 could further accelerate institutional adoption by clarifying SEC and CFTC jurisdictions. Key infrastructure players like Chainlink and Ondo Finance stand to benefit from increased on-chain asset issuance.

Bernstein's supercycle call adds institutional weight to the tokenization narrative. With stablecoins, RWAs, and prediction markets all projected to roughly double, 2026 could mark the inflection point where traditional finance fully embraces blockchain infrastructure.

Wall Street giant Citigroup projects Bitcoin could reach $143,000 within 12 months, citing ETF demand and regulatory tailwinds as key catalysts.

The largest US bank is assessing spot and derivatives trading services as regulatory clarity enables traditional finance to deepen crypto involvement.

Senator Boozman postpones Digital Asset Market Clarity Act from January 15 to final week of January to secure bipartisan support.

Disclaimer: News content is for informational purposes only and should not be considered financial advice. Market conditions can change rapidly. Always conduct your own research.