STRICT-Score

Max. Potenzial

8x

Potenzieller Ertrag

Wahrscheinlichkeit

70%

Erfolgschance

Risikoniveau

4/10

Mittleres Risiko

Marktkapitalisierung

$1.06B

Volumen

$88.66M

STRICT-Score Aufschlüsselung

Unser proprietäres Bewertungssystem evaluiert Projekte anhand von 6 Schlüsseldimensionen.

Analyseübersicht

Analyseübersicht

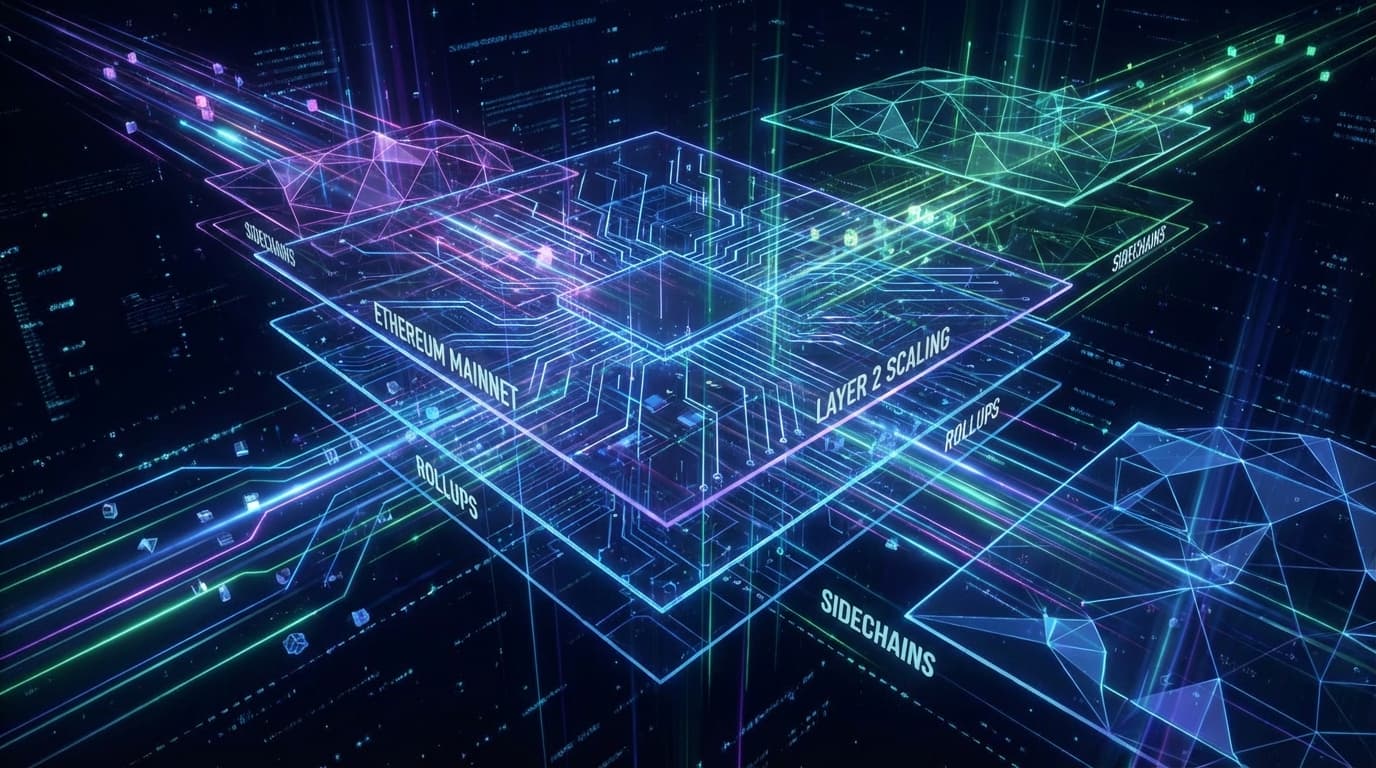

Arbitrum (ARB) is the dominant Ethereum Layer 2 scaling solution, currently trading at $0.21 with a market cap of $1.21 billion and 5.62 billion ARB in circulation (56% of max supply). Despite a 72% decline over the past year, Arbitrum maintains its leadership position with $19.21 billion in TVL across over 600 dApps, representing 37.1% of the L2 market share. The network processes 2.16 billion transactions and supports 1.45 million active wallets, with daily DEX volumes consistently in the billion-dollar range. Recent trading shows a 4.5% uptick with $128 million in 24-hour volume.

Investitionsthese

Arbitrum represents the institutional-grade Layer 2 investment thesis for Ethereum scaling. With $19.21 billion TVL (70% year-over-year growth) and 37.1% L2 market share, it holds a commanding lead over competitors. The revolutionary Stylus upgrade enables smart contracts in Rust, C, and C++, expanding the developer base from thousands to millions and unlocking compute-intensive use cases like onchain AI and advanced cryptography. The DAO controls a $3+ billion treasury funding ecosystem growth, while partnerships like Robinhood's tokenized securities launch on Arbitrum One validate enterprise adoption. At 91% below ATH and with major unlocks concluding in March 2027, current prices offer asymmetric risk-reward for patient capital betting on Ethereum's L2-centric roadmap.

Wettbewerbsposition

Arbitrum dominates the L2 landscape with $19.21B TVL versus Optimism's $9B and Base's growing presence. The 37.1% market share reflects deep ecosystem moat: native protocols like GMX create switching costs, while Stylus provides unique technological differentiation that zkSync's zero-knowledge approach and Base's Coinbase distribution cannot replicate. The combination of first-mover advantage, $3B treasury for grants, and WebAssembly innovation positions Arbitrum institutional default for serious L2 deployment. Main competitive threat is Base capturing retail mindshare through Coinbase integration, though Base lacks a token for speculation.

Fazit

Arbitrum offers compelling asymmetric risk-reward at $0.21, down 91% from ATH. The $19.21B TVL, 37.1% L2 market dominance, revolutionary Stylus technology, and $3B treasury provide substantial downside protection. While unlock pressure persists through March 2027, much appears priced in at current levels. For investors with 18-24 month horizons betting on Ethereum's L2-centric scaling roadmap, Arbitrum represents the highest-conviction play in the category. The combination of market leadership, technical innovation, and enterprise validation makes it the institutional default L2 investment.

Stärken

- Market-leading $19.21 billion TVL with 37.1% L2 market share, processing 2.16 billion transactions across 1.45 million active wallets

- Stylus upgrade unlocks Rust/C++ smart contracts via WebAssembly, expanding addressable developer market from thousands to millions while enabling compute-intensive applications impossible in Solidity

- Massive $3+ billion DAO treasury generating $50+ million annual sequencer revenue, funding ecosystem growth through programs like Stylus Sprint (147 applications for 32M ARB)

- Blue-chip DeFi ecosystem with $6.8 billion stablecoin market cap, hosting GMX, Uniswap, Aave, and native protocols driving billion-dollar daily volumes

- Enterprise validation through Robinhood partnership launching 200+ tokenized US stocks/ETFs on Arbitrum One in June 2025

Risiken

- Ongoing token unlock pressure through March 2027 with 44% of supply still locked, creating persistent selling pressure at 12.75% annual inflation rate

- Revenue accrual gap where $50+ million annual sequencer fees flow to DAO treasury rather than token holders, limiting direct value capture

- Intensifying L2 competition from Base ($9B TVL, Coinbase distribution), Optimism (Superchain vision), and zkSync (zero-knowledge technology)

- Centralized sequencer remains single point of failure and censorship risk, though decentralization roadmap is in progress

Kommende Katalysatoren

Stylus Sprint recipients deploy 17 funded projects across privacy, AI, oracle, and tooling categories

Zeitrahmen: Q1 2025

Robinhood launches 200+ tokenized securities on Arbitrum One for EU users with real-time dividend payouts

Zeitrahmen: Q2 2025

Sequencer decentralization implementation removes censorship criticism and strengthens security model

Zeitrahmen: 2025-2026

Stylus ecosystem maturation/C++ developers launch compute-intensive dApps (AI agents, advanced DeFi)

Zeitrahmen: Q1 2026

Final major token unlocks complete, eliminating primary source of selling pressure

Zeitrahmen: March 2027

Preisziele

Extended unlock pressure through 2026 with persistent macro headwinds and continued L2 competition from Base/Optimism. Assumes TVL stagnation and developer migration to competing chains. Price represents 85% decline from current levels but aligns with December 2025 all-time low of $0.1863.

Recovery to mid-2024 levels schedule approaches completion and Stylus ecosystem demonstrates real traction with 50+ production dApps. Assumes TVL maintains $15-20B range and L2 narrative regains momentum during broader crypto recovery. Represents 160% upside with $3.1B market cap.

Unlock completion in March 2027 removes selling pressure revolutionizes L2 development with Rust/C++ adoption reaching critical mass. Enterprise adoption accelerates beyond Robinhood partnership. TVL expands to $30B+ L2s capture 50% of DeFi activity. Represents 470% upside with $6.7B fully diluted valuation, approaching prior cycle highs of $2.40.

STRICT-Score

Bewertung: 82/100 | Potenzial: 8x

Verwandte im gleichen Sektor - Layer 2

Alle anzeigenHaftungsausschluss: Diese Analyse dient nur zu Informationszwecken und sollte nicht als Finanzberatung betrachtet werden. Führen Sie immer Ihre eigene Recherche durch, bevor Sie Anlageentscheidungen treffen. Investitionen in Kryptowährungen sind volatil und mit erheblichen Risiken verbunden.