Score STRICT

Potentiel max

8x

Rendement potentiel

Probabilité

68%

Chance de succès

Niveau de risque

4/10

Risque moyen

Capitalisation

$495.16M

Volume

$61.92M

Détail du score STRICT

Notre système de notation propriétaire évalue les projets selon 6 dimensions clés.

Aperçu de l'analyse

Aperçu de l'analyse

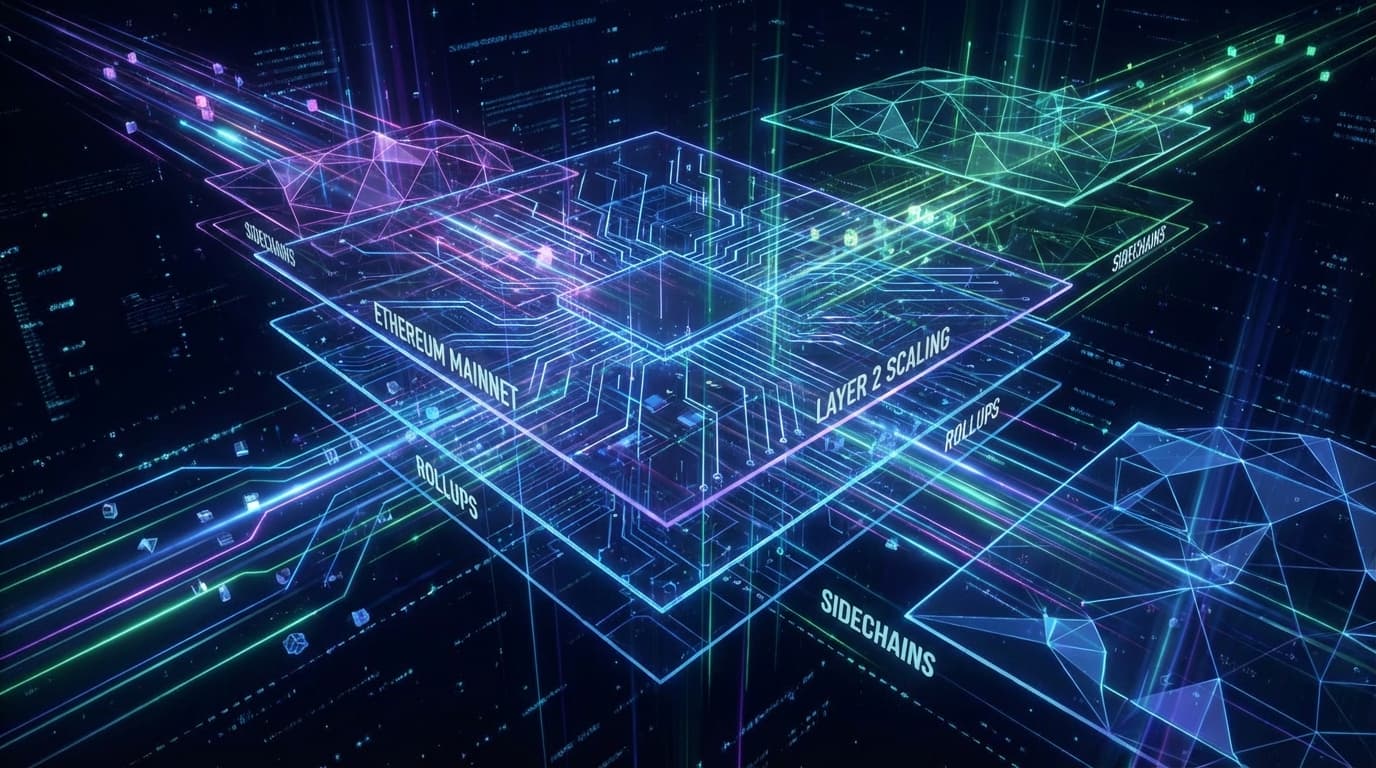

Optimism has evolved from a standalone Layer 2 into Ethereum's dominant scaling infrastructure through its Superchain architecture. As of December 2025, the OP Stack powers 40+ active chains handling over 60% of Layer 2 transactions with 11.5 million daily transactions and $6 billion in Total Value Locked. Base, Coinbase's Layer 2 built on OP Stack, dominates with 61.3% of Superchain transactions (2.4 billion total) and $4.96 billion TVL. The Superchain is projected to reach 80% of Ethereum L2 transactions by year-end 2025. However, the OP token trades at $0.32 with a market cap of $595 million, down 93.5% from its all-time high of $4.85, creating a massive disconnect between network adoption and token performance. With only 44% of the 4.3 billion token supply circulating and a 2% annual inflation rate, the token faces persistent selling pressure despite growing ecosystem utility.

Thèse d'investissement

Optimism's value proposition lies in its position's de facto Layer 2 infrastructure standard rather than a single competing chain. The OP Stack accounts for over 62% of all Layer 2 rollup transactions, creating network effects through 40+ active chains including Base ($4.96B TVL), Worldchain, and OP Mainnet. Unlike Arbitrum's single-chain approach with 51% L2 market share, Optimism's multi-chain Superchain strategy enables rapid ecosystem expansion while maintaining shared security and interoperability. The evolution of Retroactive Public Goods Funding with 20% of initial supply (860 million OP tokens) dedicated to rewarding ecosystem builders positions Optimism for sustainable long-term growth. The Retro Funding: Dev Tooling program allocates 8 million OP monthly from March-July 2025 for open-source development. Base's institutional backing from Coinbase, which serves 10+ million users, provides a credibility moat and user acquisition channel. The critical investment question centers on whether governance will implement value capture mechanisms like sequencer fee redistribution or staking rewards to align token economics with the $6+ billion TVL the network secures.

Position concurrentielle

Optimism occupies a unique infrastructure-layer position distinct from direct Layer 2 competitors. While Arbitrum leads in single-chain TVL ($8+ billion vs OP Mainnet's portion of $6B total Superchain) and holds 51% Layer 2 market share, Optimism's Superchain model creates ecosystem lock-in through 40+ interconnected chains that isolated competitors cannot replicate. The OP Stack's 62% share of Layer 2 rollup transactions demonstrates technical superiority in developer experience, with EVM-identical tooling lowering migration barriers. Base's 61.3% contribution to Superchain transactions positions Optimism strongly in consumer applications, while Arbitrum retains institutional DeFi mindshare with platforms like GMX. The competitive dynamic favors Optimism in scalability (4,000 TPS peak) and developer accessibility versus Arbitrum's concentration advantages in per-chain value capture. However, centralized sequencer operation December 2025 lags zkSync and StarkNet's decentralization progress. The Superchain's projected 80% L2 market share by year-end 2025 would represent a decisive infrastructure victory, though token value capture remains unproven.

Conclusion

Optimism presents a rare asymmetric opportunity where exceptional network fundamentals diverge sharply from token performance. The Superchain's 60%+ Layer 2 market share, 11.5 million daily transactions, and $6 billion TVL position Optimism's scaling infrastructure leader with a credible path to 80% dominance by year-end 2025. Base's $4.96 billion TVL and Coinbase's institutional backing provide validation and user traction that competitors lack. However, the OP token's 93.5% decline to $0.32 and governance-only utility create a fundamental disconnect where network success does not translate to token appreciation. The investment case depends entirely on whether Optimism Collective implements value capture mechanisms like sequencer fee sharing before investor patience exhausts. At current $595 million market cap, even modest utility upgrades could drive substantial mean reversion toward the $2-3 range.

Points forts

- Infrastructure network effects with OP Stack powering 62% of Layer 2 rollup transactions across 40+ chains, creating ecosystem lock-in that isolated chains cannot replicate

- Base

- s 10+ million user base, providing institutional validation

- Sustainable development funding through Retroactive Public Goods Funding distributing 20% of initial supply (860 million OP) to ecosystem builders, ensuring long-term runway independent of market cycles

- Technical superiority with EVM-identical OP Stack lowering developer migration barriers versus Arbitrum

- ,

Risques

- Token economics dysfunction with 93.5% decline from ATH to $0.32 and only 44% circulating supply creating persistent sell pressure from 2% annual inflation and vesting unlocks through 2027

- Base dependency concentration with 61.3% of Superchain transactions relying on Coinbase

- ,

- ,

- ,

- s value proposition

Catalyseurs à venir

Superchain reaching 80% of Ethereum Layer 2 transactions

Échéance: Q4 2025

Token utility expansion with sequencer fee sharing or staking

Échéance: 2026

Retro Funding: Dev Tooling program monthly distributions

Échéance: March-July 2025

Interop Layer launch for cross-chain messaging across Superchain

Échéance: Q4 2025 - Q1 2026

Major institutional Superchain launches beyond Base

Échéance: 2026

Objectifs de prix

Continued selling pressure from 2% annual inflation and vesting unlocks, Base dependency fails if Coinbase faces regulatory pressure, no token utility implementation, broader crypto market downturn

Superchain reaches 80% L2 transaction share, Interop Layer launches successfully enabling cross-chain composability, gradual adoption growth maintains $6-8B TVL range without major utility upgrades

Governance implements sequencer fee sharing or staking mechanism creating organic buy pressure, Base surpasses $10B TVL milestone, additional Fortune 500 Superchain member announced, crypto market bull cycle resumes

Score STRICT

Score: 80/100 | Potentiel: 8x

Cryptos du même secteur - Couche 2

Voir toutAvertissement: Cette analyse est fournie à titre informatif uniquement et ne doit pas être considérée comme un conseil financier. Faites toujours vos propres recherches avant de prendre des décisions d'investissement. Les investissements en cryptomonnaies sont volatils et comportent des risques significatifs.